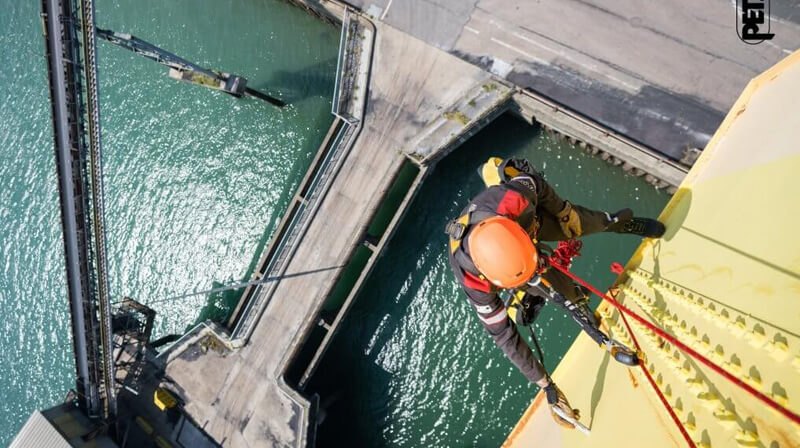

Wij zijn uw partner voor veilig werken op hoogte

Felix Safety is al meer dan 20 jaar specialist op het gebied van veilig werken op hoogte.

Uw persoonlijke full-service partner

Safety First

Felix Safety is uw full-service partner voor valbeveiliging. Wij verkopen en verhuren premium valbeveiliging-, reddings- en evacuatieoplossingen aan professionals die werken op hoogte. Vanaf 2,5 meter is dit verplicht. Daarnaast zijn wij gecertificeerd om de periodieke keuringen van materialen te doen. Daarnaast kunnen wij, onder andere, de volgende trainingen voor u verzorgen:

- Werken op hoogte

- Werken op hellende daken

- Besloten ruimtes

- Rope Acces training

- Rescue training

Voor hulpdiensten, reddingsteams en brandweerlieden verzorgen wij specifieke rescue trainingen. Informeer hier naar uw mogelijkheden.

Keuring van valbeveiliging

Webshop

Focus op veiligheid

Felix Safety levert alles wat een professional nodig heeft om veilig te kunnen werken op hoogte: van harnassen, leeflijnen en helmen tot valblokken. Voor iedereen die werkt in de sector: olie & gas, windenergie, bouw & constructie, chemische industrie of bij brandweer & hulpdiensten.

Systeeminstallatie

Neem contact op

Wilt u een RI&E laten uitvoeren? Een PBM-plan laten maken? Een keuring of inspectie aanvragen? Meer informatie over een van onze producten of wilt u een training volgen? Neem gerust contact met ons op!

- +31 (0) 346 – 555622

- Industrieweg 36-04 - 3606 AS Maarssen

- info@felixtradingbv.nl